Last week, Celent held a webinar to report out on the results of a survey of 110 financial services professionals conducted in October 2013. The objectives of the survey were to: 1) gauge the importance of innovation to business strategy, 2) identify key benefits from innovation, and 3) detail the common barriers to implementation. The responses reflect the opinions of middle and senior level employees of North American and European banks, insurance companies, and securities firms.

One of the key survey areas dealt with the support structures in place for innovation in financial services firms. Questions about organizational design, responsibilities at senior levels and tools and processes were asked of those companies with active innovation programs.

Survey Says: Investments of Time/Resources/Commitment Lacking

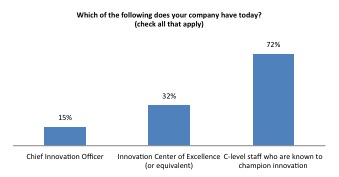

The survey found that, with a few exceptions, investments have not been made in new organizational support for sustained innovation. Allowing for multiple answers, the responses demonstrated that only a few (15%) of companies have a specific senior role dedicated to innovation in the form of a Chief Innovation Officer. Most (72%) companies report that their C-level leaders are expected to champion innovation efforts as part of their day-to-day responsibilities. One-third report that a specific center of excellence has been established. Celent’s conclusion from these three data points is that financial services firms are largely relying on existing structures to deliver innovation.

Participants were also asked to rate the apparent level of support for innovation from people in their organizations with various titles and roles, on a scale of one (low levels of support) to 10 (high levels). Their responses were processed using a modified Net Promoter Score (NPS) approach, where a rating of their colleagues from 1 to 6 puts those colleagues in the Innovation Detractor category, and ratings of 9 or 10 puts those colleagues in an Innovation Promoter category. (Ratings of 7 or 8 were ignored.) The Net Promoter Scores by title are obtained by subtracting the percentage of Innovation Detractors from the percentage of Innovation Promoters.

How well do people with these titles publicly support your company’s innovation efforts?

Not surprisingly, CEOs (NPS = +12%) and Chief Innovation Officers (NPS = +33%) had high, positive Net Promoter Scores for their support of innovation, indicating that respondents think they are supporting their firms’ innovation efforts fairly well. While 25 percent of responses for Chief Innovation Officers fell in the Detractor bucket, this may be a comment about resource issues generally, not a broad sense that Chief Innovation Officers lack passion for their function.

But what about people in the other functions? Is it possible that 25 percent of CEOs, 65 percent of CFOs, 39 percent of COOs and 41 percent of line of business heads are not buying into the need for innovation, or cannot support it adequately? Based on recent discussions of this data with industry leaders, the unfortunate answer is yes.

Theory and Reality

For most people, it is hard to argue with innovation in theory as a powerful tool that can be aimed at improving products, processes, and services. But that broadly positive view is often out of sync with how executives behave when faced with real-world problems and conflicting demands. People outside the C-suite are understandably harsh critics when their company’s leadership behaves appears to support innovation only in word only.

These results suggest that many CEOs present themselves as innovation practitioners but are not incorporating innovation best practices into their own thinking. They may get “the vision thing” regarding innovation, and talk it up in the quarterly newsletter. But many have not acted on other essential elements, like understanding the current state of innovation, modifying their organization design to build an innovation infrastructure, and changing performance management approaches to reward and recognize the behaviors that will truly transform their businesses.

Leadership Required

In financial services, there are very few firms that are seen as “innovative” by their customers. This value branding is still available to the companies that successfully build innovation as a corporate strength. For leaders who wish to align company execution with strategic intent regarding innovation, the status quo must be broken. The winners will focus their leadership capital, processes, tools and staff on changing their business as usual approach.

What Do You Think?

Do these results align with what you are seeing in companies? Is this a problem? Let us know what you think in the are area below.

Editor’s Note: Mike Fitzgerald is a Senior Analyst in Celent’s insurance practice. He has specific expertise in property/casualty automation, operations management and insurance product development. Mike will be presenting at several sessions during the Insurance-Canada.ca Technology Conference 2014 in March. He hopes to see you there!

Editor’s Note: Mike Fitzgerald is a Senior Analyst in Celent’s insurance practice. He has specific expertise in property/casualty automation, operations management and insurance product development. Mike will be presenting at several sessions during the Insurance-Canada.ca Technology Conference 2014 in March. He hopes to see you there!

If these are the results for large corporations that have the financial resources to allocate to an “innovation” role, what are the realities in brokerages where financial resources are simply not there, yet consumers are expecting their broker to deliver what the competitor delivers?

Hi Wendy. As John Foreman pointed out, at its basic level innovation = change. I sense that a number or brokers do keep making changes, innovating in their march to market and better customer service. Although there is always more that can be done, the advantage may be to the smaller organization where good leadership can make changes much more quickly and easily than they could in a large organization.

….doug