Venture capital interest in Canadian start-ups, particularly tech, has skyrocketed in 2021, drawing capital from both domestic and foreign investors —

By Charles McGrath, Senior Writer, Preqin —

Venture capitalists have taken a shine to Canadian companies in recent years. This could be surprising to some, who see the country’s investment ecosystem revolving around energy and natural resources. So far this year, more than $6.2bn has been invested in Canada-based portfolio companies, adding some momentum to a trend that temporarily flatlined in 2020.

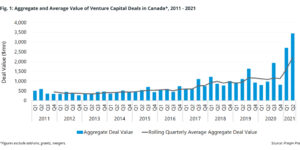

Average deal value in Canada has spiked in the first half of 2021 (Fig. 1). This is consistent with the global deals trend and that of its southern neighbor, although with fewer deals and higher entry prices. Behind these transactions are predominantly tech-focused software, internet, and cybersecurity companies, which were involved in many of the top deals and remain the chief drivers of venture capital-backed innovation in Canada.

Figure 1:

Software companies in Canada received $2.6bn in funding through most of the first half of the year, already $600mn more than in 2020, but via less than half the number of total transactions. Similar trends characterized internet tech and cybersecurity companies, with the latter noting a significant bump this year.

This isn’t new for tech in Canada. Software companies have led other industries in outside investment for several years, and by a wide margin. In each of the past five years, software and internet companies assumed an annual average of 49% of all venture capital investments made in Canadian companies by both foreign and domestic investors.

Canadian venture capitalists, led by BDC Capital and Novacap, have been active in domestic tech deals. But over the past five or so years, US mainstays Vista Equity Partners, Thoma Bravo, and KKR have ventured north. Since 2016, each of these managers has closed more than $1bn in deals for Canadian tech companies.

Read the full blog via Preqin: Investors Pour Venture Capital into Canada.

About Preqin

Preqin is the Home of Alternatives, foremost provider of data, analytics and insights to the alternative assets community. From pioneering rigorous methods of data collection to developing a revolutionary platform, we have committed ourselves to furthering the understanding of alternatives for over 17 years. Through close partnership with our clients, we continuously build innovative tools and mine new intelligence to enable them to make the best decisions every day. Today, more than 100,000 industry operators use our products, ranging from fund managers and investors to service providers and commentators. We are the only data and insights provider to cover the whole of the alternatives industry, spanning private equity & venture capital, hedge funds, private debt, real estate, infrastructure and natural resources. Our flagship platform is Preqin Pro, the largest and most versatile data and analytics source for alternatives. We also produce market-leading research reports, as well as tools for analytics, portfolio management, and due diligence to help fund managers and allocators to make the best possible investment decisions. For more information, visit www.preqin.com.

SOURCE: Preqin

Tags: InsurTech, joint venture, startup, Strategic Investment, technology investment