Sustained growth in Property & Liability pushes acquisitions, InsurTech investments

Atlanta, GA (Nov. 8, 2018) – U.S. independent insurance agents and brokers can celebrate a four-year growth trend, reports Reagan Consulting with the release of its third-quarter Organic Growth and Profitability (OGP) study. The industry organic growth rate in Q3 was 6.1% – tied for the highest growth rate in the last 15 quarters.

“This strong Q3 performance is another confidence builder for the industry,” says Harrison Brooks, vice president of the firm.

All lines of business contributed to the strongest nine-month growth performance since September 2013. Commercial lines led industry growth at 6.8%, surpassing group benefits growth for the first time since 2014. Group benefits continued strong growth at 6.3% and personal lines – at 3.8% growth – posted its highest Q3 growth rate since Reagan began the OGP survey in 2008.

All lines of business contributed to the strongest nine-month growth performance since September 2013. Commercial lines led industry growth at 6.8%, surpassing group benefits growth for the first time since 2014. Group benefits continued strong growth at 6.3% and personal lines – at 3.8% growth – posted its highest Q3 growth rate since Reagan began the OGP survey in 2008.

Brokers expect strong growth throughout 2018, estimating a full-year growth rate of 6.0% versus just 4.5% in 2017. “If history is any indication of future performance,” says Brooks, “strong GDP tailwinds are likely to continue to drive strong organic growth for agents and brokers.”

The strong growth performance in the last quarter has been accompanied by significant investment activity in the insurance distribution space. “Sustained organic growth and healthy industry fundamentals,” notes Brooks, “have led to some big bets being placed on both the acquisition and insuretech fronts.”

Three recent acquisitions were announced at record valuations: the $6.3 billion acquisition of JLT by Marsh & McLennan; the $700-plus million acquisition of Hays Companies by Brown & Brown; and the minority investment in HUB by Altas Partners of Toronto, Ontario.

Big bets have also been placed on the insurance technology front. CapitalG, Google’s investment arm, purchased a large minority stake in Applied Systems. Meanwhile, Salesforce, no longer satisfied to just be a customer relationship management tool, is aggressively pursuing new agency partnerships and is aspiring to become the industry’s next major agency management system.

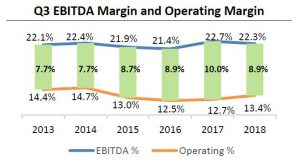

Despite the bullish outlook for the industry evidenced by these investments and the strong growth performance, Reagan leadership did express one note of caution around agency profitability. “It will be important to monitor EBITDA [earnings before interest, taxes, depreciation and amortization] margins, especially in larger agencies,” says Brooks. EBITDA margins declined slightly in Q3 2018 from last year, and it appears that contingent income, which dropped from 8.6% of revenue in 2017 to 8.0% of revenue in 2018, was the primary driver.

The reduced spread between EBITDA margins and operating margins supports that conclusion. Operating margins exclude contingent income and can be managed by the agency through operating efficiencies and expense controls. Q3 reporting brokers and agents did experience an encouraging uptick in Q3 operating margins, sparking hope that the recent dip in EBITDA margins “can be tempered by agencies continuing to improve their operating margins, which is the best indicator of structural profitability,” says Brooks.

Reagan Consulting has conducted its quarterly survey of agency growth and profitability since 2008, using confidential submissions from nearly 200 midsize and large agencies and brokerage firms. Over half of the industry’s 100 largest firms participated in this quarter’s survey. The OGP study is the industry’s preeminent survey of midsize and large privately held brokers.

About the Survey

Each participating agency receives a customized, confidential report of its performance compared with the overall survey results, along with Reagan’s quarterly commentary of industry trends affecting agents and brokers.

About Reagan Consulting

Reagan Consulting is a management consulting firm providing strategic consulting, valuation, and merger-and-acquisition (M&A) services to the independent insurance distribution system. The firm’s services for insurance agents and brokers, bank-owned agencies and other participants in the insurance distribution marketplace include: appraisals of fair market value, mergers and acquisitions advisory, ownership perpetuation planning, strategic planning facilitation, key employee compensation and equity plan design, and agency performance benchmarking. Reagan Consulting co-developed the well-known Best Practices Study and produces the quarterly Organic Growth & Profitability benchmark survey. For more information, visit ReaganConsulting.com.

Source: Reagan Consulting