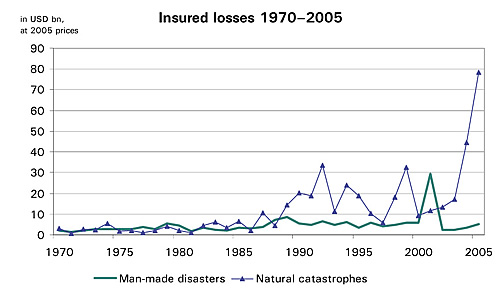

In 2005, more than 97 000 people lost their lives due to natural catastrophes or man-made disasters. The Swiss Re sigma statistics for 2005 counted almost 400 catastrophes, which caused damage totalling more than USD 230 billion. About one third, or USD 83 billion, was covered by insurance. In the previous year, insured catastrophe losses had amounted to USD 48 billion. 2005 turned out to be the costliest year ever for property insurers.

24 Feb 2006

More than 97 000 die in catastrophes

Still recovering from the tsunami of December 2004, Asia was again hit by a severe natural catastrophe: on 8 October 2005, an earthquake measuring 7.6 on the moment magnitude scale shook the mountain region of Kashmir. More than 73 300 people lost their lives, 72 000 of them in Pakistan and 1 300 on the Indian side. Over the whole of 2005, more than 97 000 people died in catastrophes.

Total damage amounts to USD 230 billion

Natural and man-made catastrophes in 2005 caused USD 230 billion of damage to buildings, infrastructure, vehicles, or losses to directly affected businesses. Hurricane Katrina entailed the highest total damage by far, at USD 135 billion. Hurricane Wilma ranked second, with destruction amounting to USD 20 billion, followed by hurricanes Rita at 15 and Dennis at 4 billion. The total damage of the Kashmir earthquake is estimated to be USD 5 billion. Man-made disasters triggered damage totalling USD 10 billion, the most costly being the terrorist attack in London in July, explosions in oil processing plants in Canada in January and in the US in March, and the riots in France in October and November.

At USD 83 billion, insured losses take on a new dimension

Claims to property insurers added up to USD 83 billion: 78 billion stemmed from natural catastrophes, and 5 billion from man-made disasters. The hurricanes in the US and Caribbean dominated the record-high losses, mainly as a result of four hurricanes making landfall in the US. Hurricane Katrina alone triggered claims of USD 45 billion, followed by hurricanes Rita and Wilma at USD 10 billion each and Dennis at USD 1 billion. The hurricane season 2005 also broke several meteorological records: 27 named storms (previous record year: 1933 with 21), of which 15 reached hurricane windspeeds (previous record year: 1969 with 12). For the first time ever, three hurricanes attained category 5, the highest on the Saffir-Simpson scale.

In Europe, winter storm Erwin and summer floods in the Alps each cost property insurers USD 1.9 billion. Man-made disasters triggered claims adding up to USD 5 billion worldwide, the costliest being explosions in oil-producing plants in Canada and the US, and fires at electronic equipment manufacturers in Taiwan and Malaysia.

Prospects: more strong hurricanes during AMO warm phase

The increase in hurricane losses is related to the warm phase of �Atlantic multidecadal oscillation� (AMO) in the North Atlantic. This warm phase started in 1995 and is expected to last for another 10 to 30 years. Given such climatological conditions, propitious to windstorms, the above-average hurricane activity can be expected to continue, entailing more intense hurricanes.

About Swiss Re

Swiss Re is one of the world�s leading reinsurers and the world�s largest life and health reinsurer. The company operates through more than 70 offices in over 30 countries. Swiss Re has been in the reinsurance business since its foundation in Zurich, Switzerland, in 1863. Swiss Re offers a wide variety of products to manage capital and risk. Traditional reinsurance products, including a broad range of property and casualty as well as life and health covers and related services, are complemented by insurance-based corporate finance solutions and supplementary services for comprehensive risk management. Swiss Re currently has the following ratings: (i) from Standard & Poor’s: long-term counterparty credit, financial strength and senior unsecured debt ratings of “AA (CreditWatch negative)”, and a short-term counterparty credit rating of “A-1+”, (ii) from Moody’s: insurance financial strength and senior debt ratings of “Aa2” (on review for possible downgrade), and a short-term rating of “P-1” and (iii) from A.M. Best: a financial strength rating of A+ (superior) (under review with negative implications). website: http://www.swissre.com/