Protiviti survey finds finance leaders concerned about security, data and internal customers

Menlo Park, CA (Oct. 3, 2019) – Global consulting firm Protiviti has released the findings of its annual Finance Trends Survey, which reveals the continuation of a significant shift in the priorities and activities of Chief Financial Officers (CFOs) and senior finance executives. Survey respondents rated different areas in the finance function to reflect their priorities and areas of concern for the next 12 months. Over 70% of CFOs and vice presidents of finance view ‘strategic planning’ as one of the highest priority areas in which they want to improve their knowledge and capabilities, highlighting the need for these finance leaders to focus on strategic matters as much as operational and day-to-day finance and transactional matters.

“The data-driven nature of today’s finance function makes the CFO invaluable in setting and executing the company’s strategy, especially when it comes to forecasting trends or managing government and regulatory relationships,” said Chris Wright, a Protiviti managing director and global leader of the firm’s Business Performance Improvement practice. “These finance leaders are no longer siloed to financial and operational issues; rather they’re expected to deliver insights and analysis that help shape critical business decisions.”

The Protiviti survey report, Today’s Finance Priorities: Security, Data, Analytics and Internal Customers, is based on a survey of 817 CFOs, vice presidents of finance, finance directors, controllers and other finance professionals at both public and private companies from around the world, and representing a wide range of industries. Fifty-eight percent of companies surveyed have revenues of US$1 billion or more.

Finance Professionals Prioritize Data Security and Internal Customer Service

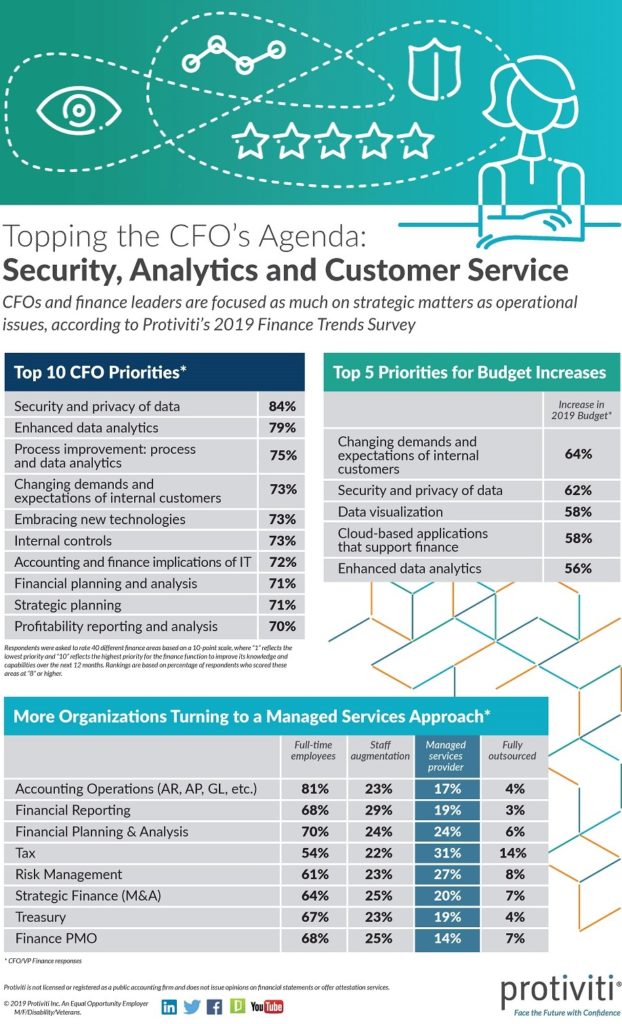

With the prevalence of data breaches hitting businesses today, understandably, security and data privacy are ranked as a priority for finance teams to focus on during the next year, with 84% of CFOs and VPs of finance and 77% of other finance professionals rating it as a high priority.

“A data breach – whether related to financial or nonfinancial data – can have severe financial and reputational ramifications and as cyber risks increase, finance leaders must adequately budget, allocate resources and prioritize company-wide security and data protection measures,” said Wright.

Strategic decision-making within organizations is being informed by data more than ever. As a result, the CFO’s internal customers are increasingly requesting that the finance function provide real-time information with specific insights, metrics and enhanced data analytics about the organization’s financial and operational performance. Nearly eight out of ten (79%) CFOs/VPs of finance and 70% of other finance professionals cited enhanced data analytics as a priority for the finance function to improve its knowledge and capabilities over the next year to help them exceed their internal customers’ expectations. Meeting the changing demands and expectations of internal customers is also a top area driving finance workforce increases.

Scaling the Finance Workforce Up (and Down)

As a result of the changing demands and expectations of their internal customers, 61% of CFOs/VPs of finance plan to increase the finance function’s employee count in the next year. These respondents also cited cloud-based applications that support finance (49%) and data visualization (48%) as other priorities that are driving labor force expansions within the next 12 months. Of note, 28% of CFOs/VPs of finance plan to decrease their workforce in the next year due to efficiencies achieved through robotic process automation. However, other research from Protiviti, as well as recent news reports, suggests many companies are investing in long-term programs to reskill their existing workforces with new technology capabilities.

“The traditional finance labor model is being reassessed. The need to reskill today’s finance professionals is placing significant strain on existing talent management processes, including traditional approaches to recruiting and retention that fail to help finance groups quickly pivot in response to changing strategic objectives,” said Scott Bolderson, a U.K.-based managing director in Protiviti’s Business Performance Improvement practice. “As a result, more finance groups are leveraging relationships with managed services providers compared to traditional outsourcing arrangements. They are also deploying various non-full-time employees to staff larger portions of their tax, risk management, M&A and treasury functions.”

Video

Infographic

About the Study

The 2019 Finance Trends Survey report is available for complimentary download here.

Listen to a podcast featuring Wright and Bolderson highlighting key findings and recommended action items.

Protiviti also hosted a free webinar, held Sept. 24 and now available on-demand – Today’s Finance Priorities: 2019 Global Finance Trends Survey – to discuss the most important takeaways from the survey, featuring Wright, plus Matt McGivern, a managing director in Protiviti’s Enterprise Data and Analytics group, and Shawn Seasongood and Ken Thomas, Protiviti managing directors in the Business Performance Improvement practice.

About Protiviti

Protiviti is a global consulting firm that delivers deep expertise, objective insights, a tailored approach and unparalleled collaboration to help leaders confidently face the future. Through its network of more than 80 offices in over 25 countries, Protiviti and its independently owned Member Firms provide clients with consulting solutions in finance, technology, operations, data, analytics, governance, risk and internal audit.

Named to the 2019 Fortune 100 Best Companies to Work For® list, Protiviti has served more than 60 percent of Fortune 1000® and 35 percent of Fortune Global 500® companies. The firm also works with smaller, growing companies, including those looking to go public, as well as with government agencies. Protiviti is a wholly owned subsidiary of Robert Half (NYSE: RHI). Founded in 1948, Robert Half is a member of the S&P 500 index.

For more information, visit www.protiviti.com.

Protiviti is not licensed or registered as a public accounting firm and does not issue opinions on financial statements or offer attestation services.

Source: Protiviti

Tags: Protiviti, survey, trends