Digital maturity levels are growing, but unevenly

Boston, MA (Oct. 25, 2018) – Effective digital capability deployment involves not just sales and marketing, but every segment of an insurance operation. Core system enhancements and analytics investments are frequently required to prioritize, enable, and manage digital capabilities. In a new research council study, Digital Benchmarks for Insurers Across the Enterprise, research and advisory firm Novarica examines insurers’ digital capability deployment and pilot activity across dozens of functions that span marketing, distribution, underwriting, customer engagement, billing, and claims. The report also includes capsule case studies that exemplify what carriers are doing to develop their digital capabilities.

“Digital capabilities have changed dramatically over the last decade and continue to evolve rapidly,” said Chuck Ruzicka, VP of research and consulting, lead author of Novarica’s new report. “In addition to tracking their progress against the framework suggested by this report, insurers should continue to reimagine and reconceptualize their service capabilities based on agent and consumer preferences and the benefits that digitalization promises.”

A preview of the brief is available online.

Summary

This report provides benchmark data on deployment and pilot activity for digital capabilities that are commonly considered to be part of a comprehensive digital strategy. The capabilities included in this study span marketing, distribution, underwriting, customer engagement, billing, and claims. It also provides benchmark data on digital investments and summary case studies of successful initiatives.

Topics Covered:

- Current deployment rate of digital capabilities.

- Current and planned pilot activity to help insurers understand how soon emerging digital capabilities will become table stakes.

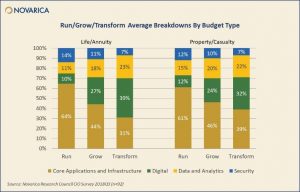

- Digital spending ratios in insurer IT budgets.

Key Points and Findings:

- Digital distribution capabilities are widespread, but maturity levels vary. Nearly all insurers have transactional agent portals, but only about a third consider their capabilities mature.

- Insurers are piloting customer engagement, claims, and billing capabilities at high rates. Large insurers are also exploring IoT data capture and other emerging technologies.

- Proliferation of channels creates additional complexity. As insurers consider expanding from Web and mobile to new channels like voice, additional complexities in content management and cross-channel consistency of experience will arise.

Click here for the table of contents or to access the report.

About Novarica

Novarica helps more than 100 insurers make better decisions about technology projects and strategy through retained advisory services, published research, and strategy consulting. Its knowledge base covers trends, benchmarks, best practices, case studies, and vendor solutions. Leveraging the expertise of its senior team and more than 300 CIO Research Council members, Novarica provides clients with the ability to make faster, better, more informed decisions. Its consulting services focus on vendor selection, custom benchmarking, project checkpoints, and IT strategy. For more information, visit www.novarica.com.

Source: Novarica

Tags: benchmarking, Digital Insurance, Novarica, strategy, Voice