New SMA Blog by Mark Breading, Partner, Strategy Meets Action

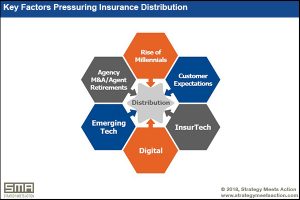

Boston, MA (July 12, 2018) – How much will the distribution of P&C insurance change in the next five years? This is anything but an academic question. Insurers, agents/brokers, and tech companies are all trying to read the tea leaves to position for success in a changing environment. InsurTechs focused on distribution are numerous; new entrants are surfacing every day. And the inexorable and rapid move to digital is the overarching theme that is affecting all of insurance, including the distribution area.

SMA’s recently released research report, The Future of Distribution in P&C Insurance: Transformation in the Digital Age, takes a look at how insurance executives believe distribution is likely to evolve. The ways that personal lines and commercial lines distribution go forward are expected to be quite different. In general, insurers expect significant consolidation among commercial lines agents and brokers and see the trusted advisor role rising in importance. Major disruption by InsurTech and entry by the global tech giants (Google, Amazon, etc.) is not anticipated to be as much of a factor, although still an important one. On the personal lines side, 59% expect major disruption by InsurTech and almost half assume that the global tech companies will play a significant role in the distribution of auto and homeowners insurance.

Other factors that will change the distribution channel environment include the continuing rise of direct (especially for personal lines) and an increase in comparative rating, which both personal and commercial lines executives foresee. There are two aspects of change that are especially noteworthy. First, almost no one predicts that insurance distribution will be largely unchanged five years out. In fact, none of the personal lines execs and only 8% of commercial lines execs responding said that distribution will be about the same in five years. The second interesting finding is that only 10% of personal lines insurers believe that agents will assume more of a trusted advisory role. In our view, it will be critical for personal lines agents to up their game. This includes becoming more of an advisor in a world that is increasingly connected, digital, and has a changing set of risks. In addition, agencies must embrace the digital world to meet customer expectations, improve operational efficiencies, and gain more insights into prospects, customers, and their insurer partners.

Insurers also expect emerging technologies to have a huge impact on distribution. Artificial intelligence, chatbots, and mobile/digital payments are the top three technologies that insurers plan to invest in over the next three years to enhance their capabilities in the distribution space.

Pundits have been predicting the demise of the agent channel for decades, yet the channel is still dominant. The word disruption has been used in relation to distribution more than any other area of insurance. And to be sure, P&C insurance distribution is poised to change significantly. But ultimately, SMA expects agents and brokers to still be playing a major role in five years, although the agencies of the future might look quite different than those of today.

About the Report

The Future of P&C Insurance Distribution provides an insurer viewpoint on how distribution is likely to change over the next five years, explores the implications of new InsurTech distribution players, and looks at insurer plans for investing in emerging technologies for distribution. Separate perspectives on P&C personal lines and commercial lines are provided.

About the Author

Mark Breading, a Partner at Strategy Meets Action, is known for his insights on the future of the insurance industry and innovative uses of technology. Mark consults with insurers and technology companies on forward thinking strategies for success in the digital age. His inventive methods and his ability to incorporate InsurTech and emerging tech into business strategies are unparalleled. Mark also leads SMA’s research program, has overseen the publication of over one hundred research reports, and directed custom research projects for insurer and tech clients. His thought leadership in the areas of InsurTech, emerging technologies, customer experience, and digital strategies has earned him rankings as a “Top Global Influencers in InsurTech” by InsurTech News and Onalytica and a place in the 10 finalists for the “Top Global IoT in Insurance Influencer Award.”

Before joining SMA in 2009, Mark spent 25 years with IBM, where he co-developed IBM’s Account Based Marketing program and led the global project office to implement ABM across all industry verticals worldwide. Mark has held both technical and business roles in sales, consulting, marketing, and business strategy and has advised insurers around the world for almost 30 years.

He is a frequent speaker at industry events; an InsurTech mentor with the Global Insurance Accelerator; and a frequent contributor of articles to Insurance Thought Leadership, Insurance Networking News, LOMA Resource, and many other industry publications.

About SMA

Exclusively serving the insurance industry, Strategy Meets Action (SMA) is an advisory services firm offering retainers, research, consulting, events, and innovation offerings to both insurance companies and solution providers. Learn more about SMA at www.strategymeetsaction.com.

SOURCE: Strategy Meets Action (SMA)

Tags: Mark Breading, outlook / predictions, Strategy Meets Action (SMA)