The Chronicle: Issue 2016-23, June 7, 2016

|

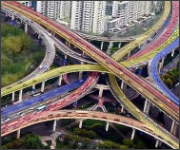

What's Going Through The Intersection of Insurance and Technology?

The Future of Work, Platforms, and Insurance |

|

Business of Insurance

Shred-It survey: Human error seen as leading cause of information security breaches

The sixth annual Shred-it Security Tracker Survey reveals that Canadian businesses view human error as the greatest risk to their information security but very few are implementing training programs and establishing protocols to help employees recognize these risks.

Chubb adds cyberbullying coverage for homeowners

Chubb has added cyberbullying coverage to its Canadian Masterpiece Family Protection policy to help cover clients and their families from the expenses associated with a cyberbullying incident.

Gartner: Enterprises should create an industry vision for digital business success

Enterprises struggling with digital business transformation can most easily pursue digital business by creating a vision for their own industry, according to Gartner

iA Financial Group launches new RESP product, My Education+

iA Financial Group has announced the launch of its new registered education savings plan (RESP) product called 'My Education+' for families who wish to save for their children's post-secondary education.

Technology

Celent report: Insurtech Has Arrived

Fintech has been a booming sector for a few years, and now Insurtech has arrived. The imperative to innovate is widely agreed across the industry, and the innovation ecosystem offers a fresh way for insurers to inject life into their innovation strategy.

Gartner: Majority of digital businesses will suffer major service failures by 2020

As organizations transition to digital business, a lack of directly owned infrastructure and services outside of IT's control will need to be addressed by cybersecurity, according to Gartner, Inc. Gartner predicts that by 2020, 60 percent of digital businesses will suffer major service failures due to the inability of IT security teams to manage digital risk.

Policy Management

X by 2: Underwriting Modernization – Why a holistic approach is a realistic approach

In the race to a more competitive market presence, many insurers have focused solely on the form and function of modern core systems, believing that just implementing them will position them well for the disruption that is already occurring in the industry. That is a myopic view that ignores the fact that many carriers have more systemic issues than a modern core systems platform alone will not be able to solve.

Majesco launches Majesco CloudInsurer offering

Majesco, a global provider of core insurance software, consulting and services for insurance business transformation, has announced the launch of Majesco CloudInsurer, an out-of-the-box repeatable, scalable cloud platform.

Distribution

Kent & Essex selects MCCG online quoting solution

Kent & Essex Mutual Insurance Company has chosen to implement MCCG's Online Quoting Solution in support of their Broker Distribution Channel. This joint project will utilize existing functionality within their Insurance Business Solution (IBS®) and will introduce the Online Quoting Solution so that Kent & Essex provides an effective means for Consumers to digitally initiate the sales process with their broker partners.

Keal gets big thumbs up for Keal Rating

Keal brokers now have an additional choice when it comes to traditional rating software. Keal Rating, powered by Intelliquote, has opened the door to efficient, real-time quoting direct from the insurer into the SIG broker management system (BMS).

Life Ant: Millennials will change how life insurance is bought

A new article from Life Ant explains that millennials will most likely revolutionize the life insurance industry by buying their life insurance policies online.

Claims

Allianz Global Assistance and PassportCard revolutionize travel insurance experience

Allianz Global Assistance Canada has announced its plans to test a new and innovative way to pay for medical claims while travelling.

A first in Canada, the unique solution will allow for payment of eligible outpatient medical expenses in real-time, eliminating any out-of-pocket expenses for the traveller and removing the typical claims process and paperwork which travellers are accustomed to.

Vericlaim expands operations in Canada

Sedgwick and its subsidiary Vericlaim, a global provider of loss adjusting and claims management solutions, have announced that they will expand their services available in the Canadian market.

Interstate Restoration creates industry giant with FirstOnSite acquisition

Interstate Restoration LLC, already a U.S. leader in disaster recovery efforts on a commercial scale, has completed the acquisition of FirstOnSite Restoration G.P. Inc. in Canada. As a result of the transaction, Interstate Restoration becomes the second-largest independent company in its industry, with nearly 1,250 employees operating in both countries.

Consumer Information

IBC warns ride-share drivers over coverage, exclusions

Using one's own car to make ends meet is a tempting concept, but one that could prove very costly for those who have not talked to their insurer first. Insurance Bureau of Canada is reminding policyholders they must inform their broker or insurance company if they're making different use of their vehicle.

Insurance Bureau of Canada welcomes commissioner's reports on environment

On May 31, Commissioner of the Environment and Sustainable Development Julie Gelfand tabled three reports in the House of Commons that highlight the need to prepare communities across Canada for the effects of severe weather. Two of these reports reinforce previous IBC findings.

IBC shares top 10 tips for hurricane preparedness

The beginning of June marks the approach of summer, and also the beginning of hurricane season for Atlantic Canada. To help ensure that everyone is prepared, Insurance Bureau of Canada is reaching out to residents with tips and information.

IBC: Tips for those returning home to Fort McMurray

Thousands of Fort McMurray residents are returning to their homes following the evacuations because of the wildfire. This will be a difficult and trying time for many residents. Those with damage to their properties will likely have a number of questions and that's why Insurance Bureau of Canada is in the community and reaching out with tips and information to help residents over the coming days and weeks.

Aviva Canada offers information about re-entry for Fort McMurray residents

As some Fort McMurray residents begin the process of voluntary re-entry into their communities once authorized by the Government of Alberta, Aviva Canada is urging them to take advantage of important information to protect themselves and their families.

IBC: Newfoundland and Labrador add retail sales tax to insurance on July 1.

In the recent provincial budget, the Newfoundland and Labrador government introduced a new 15% retail sales tax on home, auto and business insurance policies. Effective July 1, 2016, all new or renewing insurance policies in the province will be subject to this tax. In addition, the existing government tax that is paid on insurance premiums will increase by 1%.

British Columbia invests in Lower Mainland flood action plan

To better understand and mitigate the impacts of flooding along the Fraser River and southern coast as identified in Phase One of the Lower Mainland Flood Management Strategy, the Province of British Columbia is working collaboratively with all partners in the strategy and with the Fraser Basin Council by committing 1 million CAD in funding to assist with implementation of Phase Two.