The Chronicle: Issue 2014-29, July 22, 2014

|

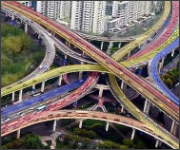

What's Going Through The Intersection of Insurance and Technology?

Project Review – Think of it as an ‘Annual Physical’

Is Communications a Lecture or a Conversation? |

|

Technology

Marsh launches cyber breach modeling capabilities

Given the growing frequency and severity of data breaches occurring in the US, properly protecting an organization's assets from such threats has become critical. Determining the proper amount of cyber insurance to purchase, however, can be challenging.

CSIO releases eSignatures vendor dashboard

The Centre for Study of Insurance Operations is pleased to announce the release of its eSignatures Vendor Dashboard, a new resource designed to facilitate the research of eSignatures solutions within the broker channel.

Claims

IBC database helps identify owners of recovered cargo

After a police raid, Insurance Bureau of Canada's cargo theft reporting program has helped police to identify the owners of property stolen over the past several months.

Aite Group: High performance claims transformation is on the horizon for the insurance industry

A new report published by Aite Group highlights the increasing role that cognitive computing will have as its ability to process knowledge catches up with the insurance industry's ability to process data in the race towards high performance claims handling.

Distribution

Great-West Life, London Life and Canada Life transform their individual insurance new business

Advisors play an integral role in helping insurers meet the individual insurance needs of Canadians, yet for decades, they have been challenged by time intensive, administration-heavy application processes and procedures. Now, Great-West Life, London Life and Canada Life have transformed how they do individual insurance new business to better serve the individual insurance needs of advisors and their clients.

Consumer Information

IBC fact check: Bill 15 will help Ontario drivers

The quick introduction of Bill 15 is a very strong message from the Wynne government that it is serious about reducing fraud and the high costs in Ontario's current auto insurance system. Here are some highlights of the legislation and how it will help Ontario drivers.

Edwards Insurance offers travel tips for snowbirds

There are many things you should know or think about when buying travel insurance for and during your trip south. Here are three pieces of information for you to consider and to help ensure that you get the best value from your insurance if and when you need it.

Industrial Alliance launches its voluntary retirement savings plan

Industrial Alliance is pleased to announce that it will be offering the voluntary retirement savings plan, effective July 15, 2014. The VRSP is a simple solution to encourage Quebecers to save for retirement.